Nvidia's circular money game exposes $4 trillion AI bubble

/Nvidia gives OpenAI $100B to buy Nvidia chips. Goldman Sachs says 15% of sales are circular. OpenAI loses $70B while data centers depreciate faster than railroads.

Nvidia caught paying customers to buy its own chips in $100B shell game

Nvidia pledged $100 billion to OpenAI, who then uses that exact money to buy or lease Nvidia chips—a circular investment scheme that Goldman Sachs estimates will account for 15% of Nvidia's sales next year, raising the devastating question: is the world's most valuable company simply paying itself? The web of circular deals extends throughout the AI industry with companies so financially interlocked that Bloomberg and NBC needed colorful charts just to map the tangled relationships, where tech giants hand each other billions that immediately flow back as revenue, creating what one expert calls "the illusion of dominance." OpenAI's $500 billion valuation depends on Nvidia's $100 billion investment representing 20% of its worth, yet the company plans to lose $70 billion over three years with spending commitments exceeding $1 trillion despite never turning a profit. As investors finally notice these companies lose more money the more customers they have—pennies to dollars on every ChatGPT query due to astronomical energy costs—one has to wonder if Nvidia's evolution from gaming graphics cards to $4 trillion AI dominance is built on genuine innovation or elaborate financial engineering?

Data centers depreciate faster than any infrastructure in history

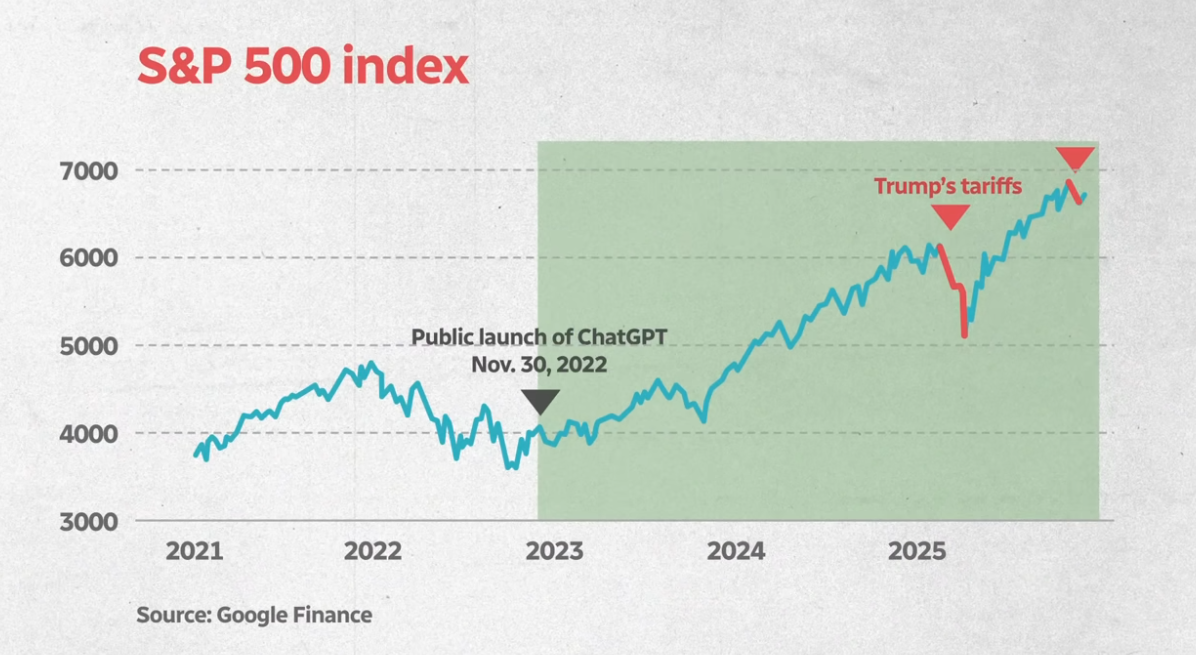

Is that a hiccup towards more gain or a downfall?

Unlike roads and railroads that remain useful for decades, the billions spent on AI data centers face a brutal depreciation reality that threatens the entire investment thesis—these giant structures filled with thousands of chips running hot 24/7 shorten their useful life with every passing second. Consider the shocking disparities between traditional and AI infrastructure:

A railroad unused for 5 years remains fully functional; a GPU becomes worthless scrap. More money now goes to data centers than all other manufacturing facilities combined

Each $40,000 Nvidia chip multiplied by tens of thousands requires constant cooling. Data centers consume power equivalent to small towns while generating zero lasting value

The expert quoted it perfectly:

"If I don't use a GPU for 5 years sitting in a data center, it's a write-off,"

creating an unprecedented deadline for trillions in AI investment to generate returns before the hardware becomes obsolete. These aren't investments in lasting infrastructure but rather massive bets on technology that depreciates faster than any asset class in history, forcing companies to generate immediate returns or watch their capital evaporate.

Tech stocks now represent half of all American wealth risking global collapse

OpenAi is raking in up to a trillion dollars in investments. But it's mostly just the same money being shuffled around across different companies. Source: Bloomberg

The AI bubble has metastasized to dangerous levels with tech stocks representing almost half the value of all American stocks, while American stocks represent more than half of all global stocks—meaning the world economy now depends on seven AI companies maintaining their speculative valuations. The Magnificent Seven together equal China's entire economy while Nvidia alone surpasses Japan's GDP, creating a situation where even a small shock could trigger extraordinary global consequences. OpenAI exemplifies the faith-based economics driving this bubble, with one expert noting: "The idea that there'll be some magical conclusion justifying all the spending is what I call faith-based argument—you don't apply that logic in any other walk of life, so why should I listen to it here?" When companies lose more money with each customer they acquire, burning cash on every query while promising eventual AGI salvation, are we witnessing the greatest infrastructure buildout in history or the most spectacular misallocation of capital ever assembled?